Have You Adapted to the Radically New Commercial Insurance Landscape?

Higher deductibles. Increased underwriting scrutiny for more locations. New deductible structures. If you own commercial properties in Texas, here’s what you must know about the rise in catastrophic weather events—and how they’re affecting your commercial real estate insurance.

Billion-Dollar Climate Disasters Are on the Rise

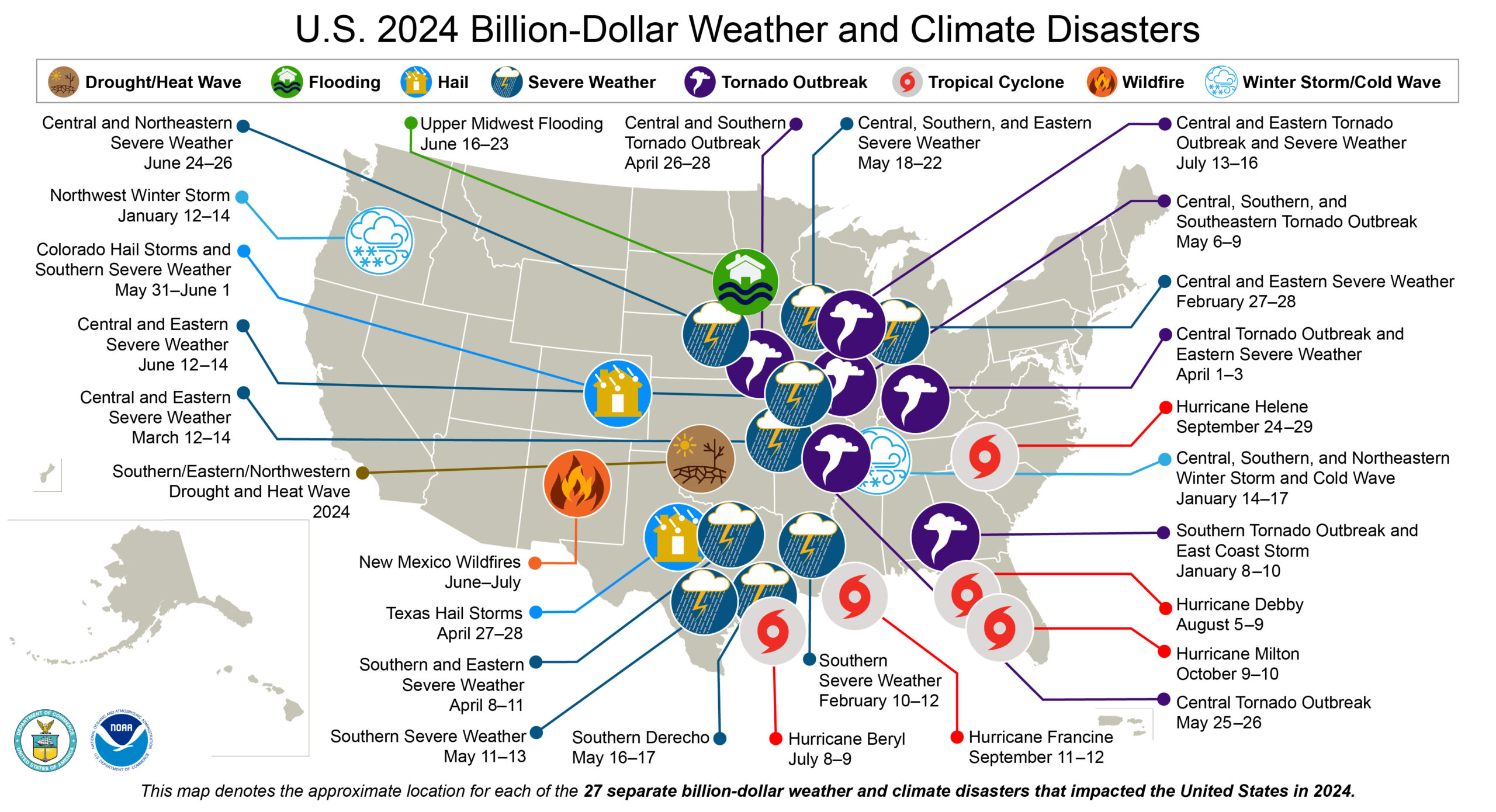

Yes, the global property insurance industry made money in 2024, but it also paid out more claims than ever before. This increase in payouts is partially tied to the rise in billion-dollar catastrophes. In terms of total volume, there were more catastrophe claims paid out in 2024 in the United States than in any previous year.

According to the National Centers for Environmental Information (NCEI) under the National Oceanic and Atmospheric Administration (NOAA), these weather and climate disasters are accelerating.

From 1980 to 2024, the annual average of weather and climate events exceeding $1 billion in losses was 9.0. (These numbers have been consumer price index, or CPI, adjusted.) In just the last five years (2020 to 2024), that annual average rose to 23.0. In 2024 alone, the United States had 27 confirmed billion-dollar weather-related disasters.

As these events with massive damage and losses become more frequent and costly, they’re having an ongoing and significant impact on the commercial property insurance market.

For people or companies with commercial real estate holdings in Texas, it’s particularly important to be aware of and react proactively to these insurance-related changes.

The Scope of Weather Catastrophes Is Changing

Historically, bad hurricane seasons aligned with spikes in these billion-dollar catastrophes. But 2023 was notably different. Only one hurricane, Hurricane Idalia, made landfall in the United States in 2023.

But despite this light hurricane season, 2023 still amassed $92.9 billion in weather-related losses and damage. That made it the ninth-costliest year on record. This was attributed largely to four major flooding events, as well as nineteen severe storm events that produced wind damage, hail, and tornadoes.

What does this tell us? The scope and composition of these catastrophes are changing. It’s not just hurricanes and earthquakes causing this level of loss anymore.

Now we’re dealing with convective storms, which bring intense rainfall, sudden tornado-level winds, and even hailstorms. On May 28, 2025, Austin Texas, suffered one of these punishing storms. It left over 180,000 people without power, and one man lost his life after getting swept away in floodwaters.

We’re also routinely dealing with increased wildfires, which are often exacerbated by windstorms and other complicating weather factors.

The statistics show that where these costly losses are happening is no longer localized to hurricane-prone coastal towns. It’s a much more expansive geographic area.

Weather Catastrophes Aren’t Just a Coastal Problem Anymore

Coastal zones and tornado-prone areas used to be the ones worrying about these weather disasters. Now even inland areas are seeing more frequent and severe climate-related exposure.

Take Nelson County, Virginia, as one devastating example. In 1969, Hurricane Camille hit Nelson County three days after making landfall along the Gulf Coast. Arriving at midnight, the storm hit the Blue Ridge Mountains and dumped approximately 25 inches of rain in about four hours. The toll on human life was tremendous. There were 124 deaths, and many of those who perished were never found.

Hurricane Ike in September 2008 serves as another example. It made landfall on the upper coast of Texas but wreaked havoc and created consequences as far as Vermont and Kentucky.

Another factor to consider is that coastal counties, in response to decades of severe weather events, have improved their building codes and enforced these tougher restrictions. They’ve also coordinated their emergency response efforts, ensuring all equipment is interchangeable. Because inland counties have historically been more insulated from this, they have not updated building codes to the same extent. This leaves inland properties potentially more vulnerable.

One thing is clear. The nature of catastrophes has changed, and having commercial property further inland no longer offers the same protection it once did.

Impact of Evolving Catastrophes on Commercial Property Insurance

For owners of commercial real estate in Texas, here are a few high-level points to consider with your commercial insurance program.

- Certain Locations Are Receiving More Underwriting Scrutiny

- Because of this changing reality, some geographic areas are now under greater scrutiny during underwriting.

- Take Austin, Texas. It currently ranks as the fifth-most vulnerable major US city for wildfire. (The four cities more vulnerable to fire are all located in Southern California.) Because Austin doesn’t have a particularly high risk for hurricanes, some commercial property owners assume securing adequate, cost-effective insurance won’t be an issue.

- Other climate-related risk factors no longer make that true.

- Expect Deductibles to Rise

- One of the biggest impacts of these weather changes has been on deductibles.

- “One of our prospects owns some commercial real estate located in central Texas,” said Mitch Davis, founder and senior consultant of MB Davis Group. “It’s nowhere near the coast. But because of convective storms, that prospect has to deal with a multimillion-dollar deductible.”

- Texas real estate property owners need to start planning for higher deductibles than they’ve experienced in the past.

- You Might Encounter Percentage Deductibles

- In today’s commercial insurance industry, percentage deductibles are increasingly common. That’s a system where you have a set-price deductible for common hazards, but for other defined perils (named windstorms, earthquakes, hurricanes, floods), your deductible is set as a percentage of the property’s value.

- For example, if the building is worth $10 million and the percentage deductible is 2%, that property owner would have a $200,000 deductible for the perils outlined in the policy. Percentage deductibles, however, can routinely go upwards of 10% of property value. For that same $10 million building, you could be looking at a $1 million deductible.

- “Today, percentage deductibles are very common. When I started my career, there was no such thing as a percentage deductible,” said Davis. “It’s just another example of ways this commercial insurance industry is moving and evolving.”

Don’t Navigate This New Normal in Commercial Real Estate Insurance Alone

As the nature of weather-related events evolves, the commercial insurance industry is constantly shifting and reacting. Those reactions result in policy changes with a dollars-and-cents impact on your:

- Premiums

- Deductibles

- Eligibility

- Terms

- Coverage amount

To safeguard your finances, you need to proactively create strategies that secure the best insurance package for your Texas commercial properties.

To get that level of industry insight and guidance, work with a commercial insurance consultant like MB Davis Group. Get in touch with our Austin-based office today.

Read More - Commercial Insurance Strategies and Risk Management

Commercial Property and Management Liability Insurance Case Study

Commercial Property and Management Liability Insurance Case Study

Commercial Property and Management Liability Insurance Case Study

How This Difficult Insurance Landscape Puts Commercial Real Estate Owners at Risk

Looming Insurance Threat for Commercial Real Estate Owners