Elevate Your Insurance

Strategy with Expert Insight

Cut costs, reduce claims, and take control—with experienced, unbiased commercial insurance consultants.

MB Davis Group

We serve as your strategic insurance partner, helping companies reduce costs, control risk, and improve claims outcomes. We don’t sell policies or earn commissions. In a volatile market, we deliver clarity, confidence, and custom-fit solutions beyond what traditional brokers offer.

Is Your Business Struggling with

Rising Insurance Costs & Limited Coverage

We empower businesses to take control of their commercial insurance

through strategic, customized solutions that reduce costs and enhance coverage.

Is Your Business Struggling with Rising Insurance Costs & Limited Coverage

We empower businesses to take control of their commercial insurance through strategic, customized solutions that reduce costs and enhance coverage.

Manage your Insurance Better

Managing your risk exposure is optimized when you have an experienced consultant team.

We distinguish ourselves by emphasizing that we don’t buy insurance – that’s what your insurance broker does. Instead, our consultants offer unparalleled benefits, including unbiased risk assessments, comprehensive coverage, favorable terms, and cost-effective premiums. With invaluable expertise, transparent fee structures, and proactive planning, we go beyond what an insurance broker can offer, delivering ultimate peace of mind for your company’s commercial insurance needs.

Why Partner with MB Davis Group

When you work with MB Davis Group, you gain more than an insurance advisor—you gain a strategic partner who understands insurance’s critical financial impact on your business. Our team combines deep industry expertise, sophisticated negotiation strategies, and a proven track record of securing significant savings while maintaining optimal coverage.

Here’s how we’ve delivered results across industries:

$600K+

Premium Reduction

Retail Distribution

Consolidated fragmented insurance programs across the U.S. and Canada, delivering $600,000 in annual savings, with an estimated 25% + reduction in premiums.

$250K+

Premium Reduction

Real Estate Development

Negotiated eased insurance requirements with lenders, achieving over $250,000 in annual premium savings for the developer.

$200K+

Annual Premium Savings

Charter Schools

Structured a tailored insurance plan for a Texas-based charter network, saving $200,000+ annually, freeing up their budget for student scholarships.

$500K+

Annual Premium Savings

Construction

Helped a construction company with high workers’ compensation premiums, despite an excellent safety record, reduce premiums by implementing a custom workers’ compensation program.

Quick Access and Personable Client Care

We pride ourselves on providing personable client care and are here to assist you.

Immediate Assistance for Your Insurance Questions

If you have quick insurance questions or need guidance on your commercial insurance needs, don’t hesitate to call us for expert assistance.

No-Charge Consultation for In-Depth Inquiries

For more in-depth inquiries or to explore how we can help you achieve better coverage and savings, book a consultation with us at no charge.

Personalized and Dedicated Services

Let’s work together to address your important commercial insurance questions and find the best solutions for your business.

“Relying solely on traditional insurance solutions can expose your business to market volatility, rising premiums, and gaps in coverage. Don’t let these risks stand in the way of growth or protecting what you’ve built.” ~ Mitch Davis

There’s a Smarter Way to Manage Commercial Insurance

We’ll look for potential risks so you can do what you do best.

We take insurance management out of your hands while helping you better understand your insurance program. That way, you’ll be ready for whatever comes your way.

We pride ourselves on being available and responsive.

Quick responses are vital to effective insurance management. We are always available to address your questions and problems.

We don’t sell insurance.

We don’t earn commissions or fees when you buy insurance, so our advice is unbiased. We work only on your side of the table.

Why You Need a Commercial Insurance Consultant

How We’re Different from Brokers

Many ask: “Why hire a consultant if we already have a broker?”

We don’t sell insurance. Instead, we partner with your broker to strengthen your coverage and provide unbiased, business-focused guidance.

Commercial Insurance Consulting that Works for You

—Not the Insurance Companies

If you’re paying $500K+ annually in commercial insurance premiums but still struggling with rising costs, slow claims, or unfavorable contract terms, MB Davis Group can help. We’re not brokers—we’re your strategic partners in smarter insurance management. Our unbiased consulting improves claims outcomes and transforms insurance from a liability into a competitive advantage.

What are the insurance risks within your industry?

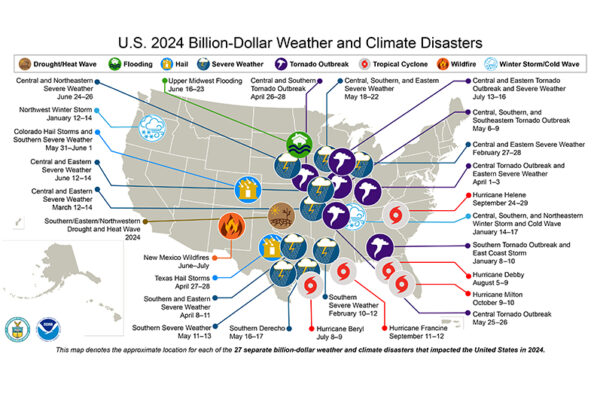

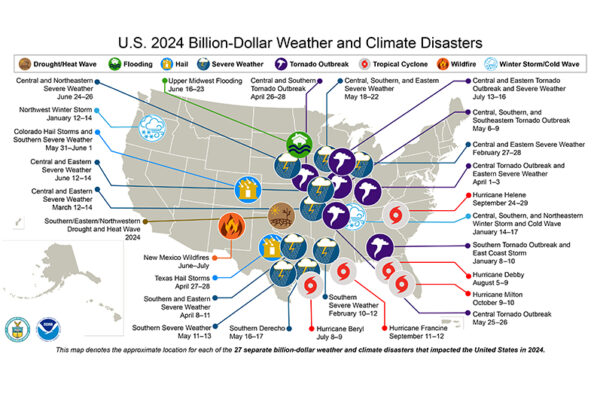

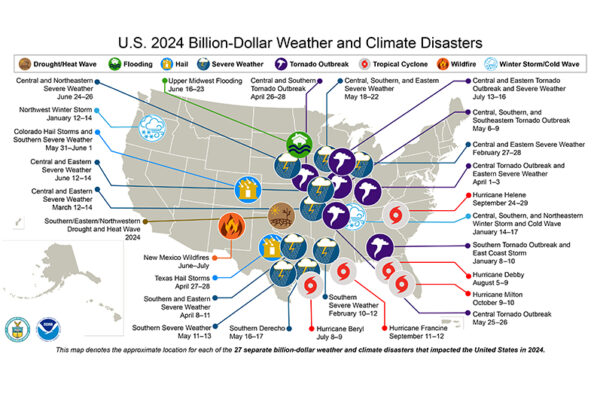

The Risk of Doing Nothing

Without a strategic risk management plan, your business remains at the mercy of rising premiums, unpredictable coverage changes, and a lack of control over claims and reserves. MB Davis Group helps you break free from this cycle.

We know the ins and outs of industry-specific insurance.

Our expertise in industry-specific insurance means we understand the risks, regulations, and opportunities unique to your business. Now we just need to get to know you. With the right strategies in place, we can align coverage, costs, and contracts so your insurance works for you—not against you.

Why Clients Across All Industries Work with MB Davis Group

Reduced Insurance Costs

Smarter strategies and risk planning that reduce premiums and protect the bottom line.

Stability in a Volatile Market

We help you avoid steep hikes and gain leverage in a hard insurance market.

Smarter Risk Management

Address root causes of claims with proactive safety and loss prevention reviews.

Faster, Fairer Claims Outcomes

We make sure your side is represented and that claims close as quickly as possible.

Unbiased, Broker-Free Advice

We don’t sell insurance. We advise you—strategically and independently.

Greater Contract Leverage

Align insurance with contracts to reduce risk and boost negotiating power.

Success Stories: What we Achieved for our Clients

Discover how companies have transformed their insurance approach with MBD Group, leading to reduced costs, improved coverage, and peace of mind.

How This Difficult Insurance Landscape Puts Commercial Real Estate Owners at Risk

How This Difficult Insurance Landscape Puts Commercial Real Estate Owners at Risk

Looming Insurance Threat for Commercial Real Estate Owners

Umbrella Insurance Is in Crisis. Here’s Why.

Commercial Insurance Is Changing for Texas-Based Real Estate Owners

LET’S TALK

TAKE CONTROL OF YOUR INSURANCE FUTURE

Get the right commercial insurance consultant on your side.

We’re proud of our work – hear from our clients.

Proactive Risk Exposure Planning is at the Core of What We Do.

You’ve put a lot into building your business – let us help you protect it.

Evaluate

Our consultants conduct unbiased risk assessments, ensuring a thorough understanding of your business’s unique exposures. No gaps, no uncertainties – just a comprehensive evaluation tailored to your needs.

Advise

Unlike brokers, we don’t sell insurance policies; we offer invaluable expertise and transparent fee structures. Benefit from our guidance on securing favorable terms and cost-effective premiums, empowering you to make informed decisions for your company.

Confidence

Proactive planning is at the core of what we do. Beyond insurance, we deliver peace of mind. Our consultants provide strategic insights, industry knowledge, and a high-level view to safeguard your asset portfolio – today and in the future.