Worsening Climate Disasters Wreak Havoc on Commercial Insurance

As a business, insurance is your safety net. If the unthinkable happens, your commercial insurance is there to protect you. As the world suffers more frequent and more costly climate disasters, this system is put under increasing pressure. With the rise of billion-dollar weather and climate disasters, the commercial insurance industry is struggling to keep up with the resulting changes. The effect is a precarious, complicated, and fraught landscape for businesses—particularly those in high-risk areas like the US Gulf Coast.

What Are Billion-Dollar Catastrophes?

A billion-dollar catastrophe is any disaster, including weather or climate events, where the overall damages incurred were $1 billion or more.

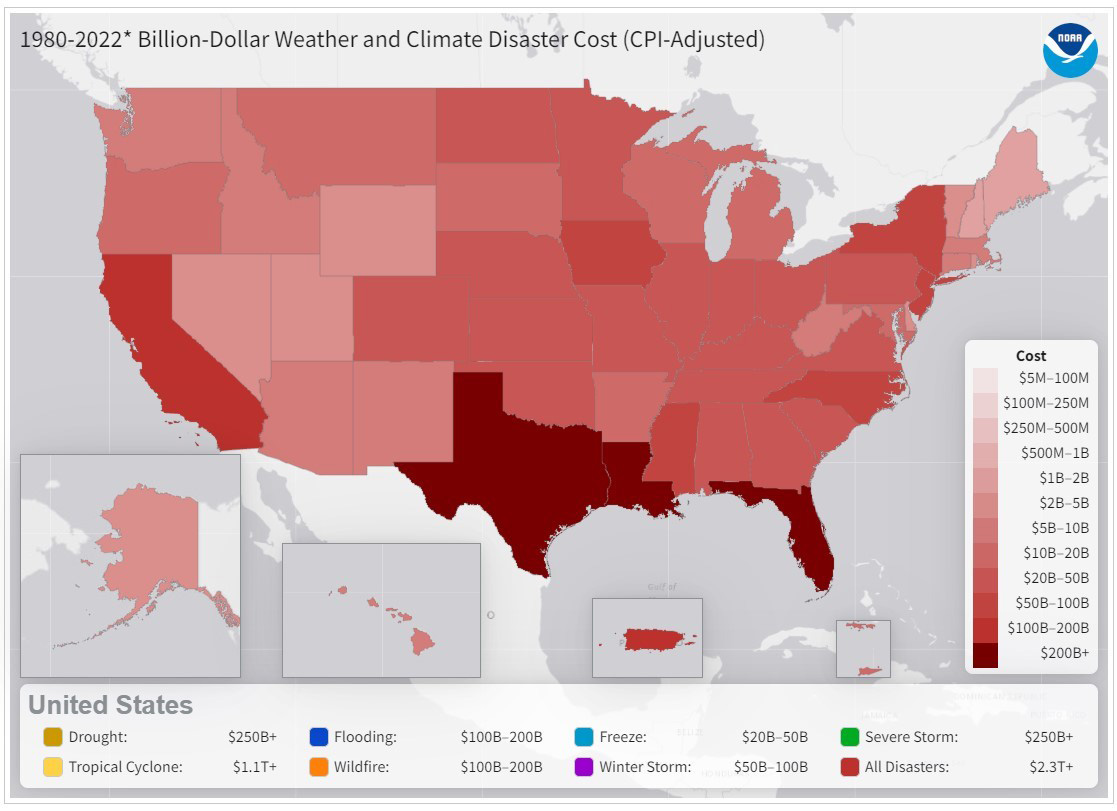

According to the National Centers for Environmental Information, since 1980, the United States has endured 338 such events related to weather or climate. The total cost is now in excess of $2.2 trillion. To put that in context, that’s more than Canada’s 2021 gross domestic product (GDP).

These climate events have included the following:

- Floods

- Droughts

- Heat waves

- Hail

- Hurricanes

- Tornadoes

- Wildfires

- Winter storms

- Other severe weather events

While the consequences of these events affect everyone, certain areas are more financially and directly impacted than others.

Since 1980, three states (Florida, Louisiana, and Texas) have all suffered more than $250 billion in weather and climate disaster costs. Puerto Rico and California are not far behind at $100–$200 billion.

Looking just at NOAA data from the most recent five-year span, it’s clear this is an accelerating problem.

Average costs related to natural disasters (as of 2021) for the three most-affected states:

- Texas: $40.5 billion

- Louisiana: $17.4 billion

- Florida: $14.4 billion

(To see the year-by-year data for any given state, use this interactive NOAA chart.)

While the financial expense of these events is staggering, it’s not nearly the full extent of the costs. Since 1980, 15,689 people have lost their lives in these disasters.

That’s also to say nothing of the less quantifiable—but no less lasting—economic and social impact of losing businesses, homes, and community members in these large-scale catastrophes.

Billion-Dollar Catastrophes Are Getting Worse…and They’re Not Slowing Down

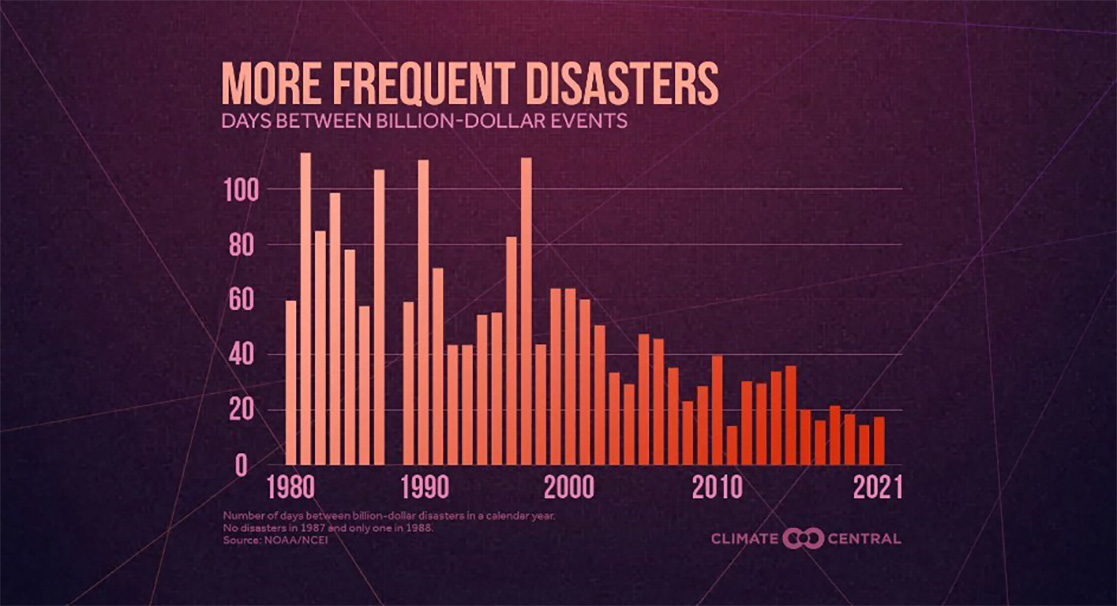

When you look at NOAA’s data, two things become clear. Billion-dollar catastrophes are getting more frequent, and they’re getting more costly.

- 1980s: 31 events; $201.5 billion in costs; 2,970 deaths

- 1990s: 55 events; $307.7 billion in costs; 3,062 deaths

- 2000s: 67 events; $576.1 billion in costs; 3,102 deaths

- 2010s: 128 events; $918.8 billion in costs; 5,227 deaths

- Last 5 years (2017–2021): 89 events; $788.4 billion in costs; 4,557 deaths

- 2021 alone: 20 events; $152.6 billion in costs; 724 deaths

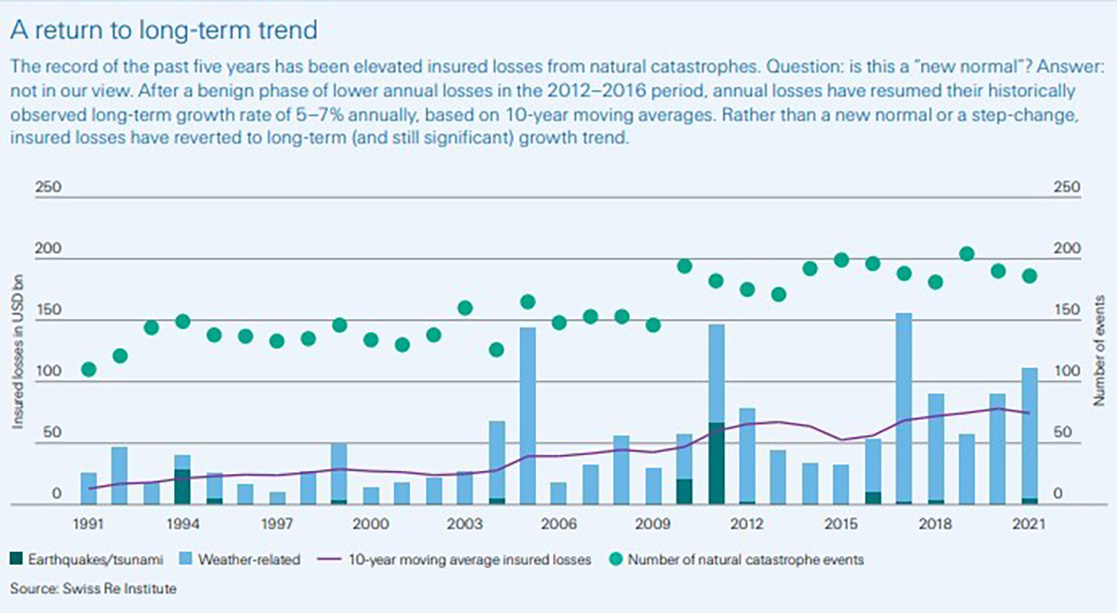

Data from Swiss Re Institute corroborate these findings.

Source: Swiss Re Institute

This isn’t about one-off disasters skewing the numbers. When looking at ten-year moving averages, these kinds of weather events are happening closer together, and the associated expense is showing a significant growth trend.

Source: Climate Central

In 2022 alone (as of October 11), fifteen billion-dollar climate events have occurred within the United States. According to Yale Climate Connections, twenty-nine have occurred globally.

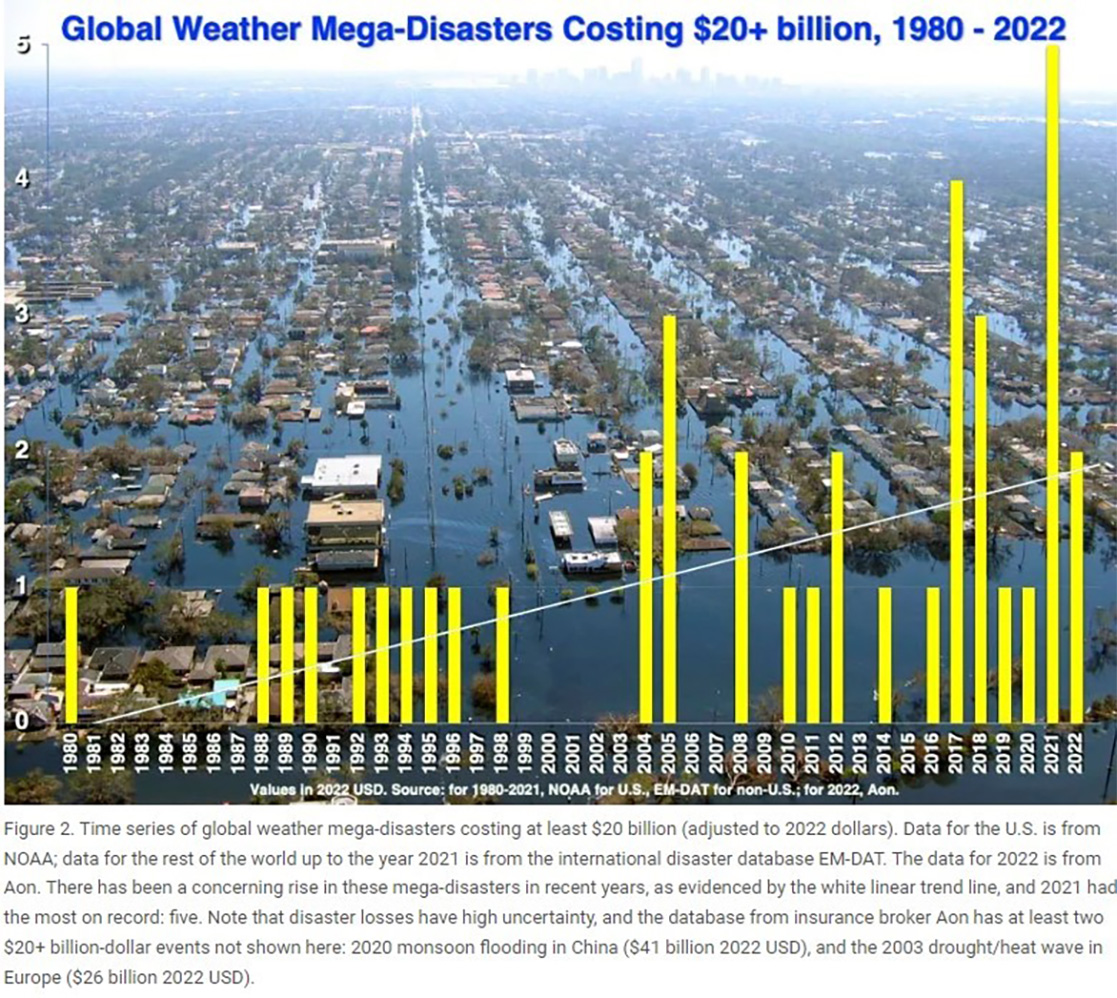

Of those, two have been mega-disasters. (A mega-disaster is quantified as any single weather or climate event costing more than $20 billion in damages.) Hurricane Ian hit the United States, and a widespread drought and heat wave raged across Europe.

Further NOAA data reveals it’s not just billion-dollar catastrophes that are on the rise. Mega disasters are becoming more common as well.

Source: Yale Climate Connections

This rise in the prevalence and severity of mega-disasters is particularly alarming. These disasters have the potential to completely overwhelm necessary local resources for response and recovery.

They also have a severe and lasting impact on institutions like commercial insurance and commercial property insurance, which are established as safeguards against these kinds of events.

10 Ways Billion-Dollar Catastrophes Are Threatening the Business Insurance Market

- Diminishes the Capacity of Commercial Insurance Providers

In order for commercial insurance companies to provide insurance to their clients, they need capital on their balance sheets. That money supports the decision to take on the risk associated with every new client. Like a bank, there are both regulatory and actuarial requirements surrounding these decisions.

With the rise in catastrophic disasters, investors who’ve put their capital into insurance companies have been losing money.

The result?

Those investors are no longer interested in investing in insurance companies. Instead, they are redirecting their capital to other more profitable industries.

This drop in funding reduces the ability of the insurance company to provide policy coverage. Much like during a food shortage, that can lead to many undesirable results, including unpredictable and drastic swings in pricing.

- Skyrockets Premiums on Commercial Property Insurance and Liability Insurance

When the financials of an insurance company are put at risk, one obvious thing happens. They charge more for their services.

The desire to bring in more revenue, coupled with the effects of diminished capacity, cause insurance premiums to go sky high. This leaves many companies unable to afford their commercial and liability insurance. They also can’t afford (or don’t want) to relocate their businesses to areas where premiums are lower.

This leaves an increasing number of businesses uninsured and vulnerable.

- Threatens Weaker Commercial Insurers with Insolvency

Insurance is built on a simple premise. Everyone frequently pays in a little to cover the large, infrequent losses of the few. It’s how commercial insurers stay solvent.

As climate disasters become more common and costly, this model is threatened for weaker commercial insurers.

For those insurers in weaker markets, even the entire network’s premiums aren’t sufficient to cover those losses when the expense of a single climate disaster reaches into the billions.

- Stresses Reinsurers

Insurance companies rarely have enough liquid cash on hand to cover extensive claims. That’s why so many rely on reinsurers to protect themselves.

Reinsurance is insurance purchased by another insurance company. It safeguards the original insurance company from the financial risk of a single catastrophic event.

This safety net is built into the commercial insurance system, and historically it’s worked well.

With the increasing prevalence of billion-dollar catastrophes, though, even reinsurers are feeling the strain.

The severity of climate events and their associated costs are testing not only the first line of defense (commercial insurers) but the secondary safeguard as well (reinsurers).

- Threatens the Protections of Business Insurance Clients

This situation puts commercial insurers in a difficult spot.

As the claims from these climate events increase, insurers are caught between two necessary things: staying profitable and complying with regulations that protect their clients.

As a purchaser of business insurance, you become more vulnerable to premium hikes and unfavorable terms as insurers are put at greater and greater financial risk.

- Creates Unrealistic Expectations in Buyers of Corporate Property Insurance

In this landscape, the current underwriting process for commercial insurance policies has changed. Many purchasers of corporate insurance expect the terms and coverage they received last year. Or five years ago. Or even ten years ago.

More and more businesses today are realizing now that’s unrealistic.

You can no longer automatically assume you’ll get the same coverage and terms you received at any point in the past.

- Makes Certain Commercial Properties Uninsurable

Commercial properties in high-risk areas are particularly vulnerable in this landscape. The commercial properties themselves could lose so much value that they become uninsurable.

Companies operating in these areas end up with fewer and fewer options, and many simply end up uninsured.

Flood zones are one prime example of this dynamic. Not many insurers are willing to cover properties against flooding. In response to that problem, the federal government initiated the National Flood Insurance Program (NFIP).

As an entity required to provide flood insurance, the NFIP was a safety net for businesses and private homes that legally needed that insurance. Under this program, businesses couldn’t be denied flood coverage, and premiums were capped.

While it seemed like a good idea, it ended up serving as a powerful case study in the real expense of covering at-risk properties. According to Vox, by 2017, US Congress had to cancel $16 billion of its debts, and as of late 2022, the program was still more than $20 billion in the red.

- Creates Exponential Climate-Related Expenses

As these catastrophic climate events happen closer together, the problems within the commercial insurance landscape only get worse.

Several factors contribute to exponential costs associated with climate disasters today:

- Increased frequency of events

- Increased financial toll of single climate events

- Diminished financial capacity of commercial insurers causing turmoil within the industry (in premiums, pricing, and terms)

- Increased cost of rebuilding after a natural disaster

- Demands Bigger Payouts on Commercial Property Insurance Claims

Another piece of this puzzle is that commercial property values continue to escalate. As properties are worth more, claims become more costly.

Whether the claim involves damage or total loss, rapidly rising property values mean business insurance providers have to pay out more. This adds further stress on the system.

The other important consideration is the sheer cost of rebuilding in the wake of a natural disaster.

If you lose a commercial property in an electrical fire, for example, that’s a certain amount to rebuild. Lose that same building in a hurricane or other catastrophe that affects many buildings in the same area, and suddenly the cost to rebuild is higher—by orders of magnitude.

Why? You’re no longer just dealing with an isolated incident. You’re contending with a host of complicating factors:

- Labor shortages within the area

- Supply chain issues associated with localized mass loss

- Increased costs of both building materials and labor

- Illuminates the Power of the Commercial Insurance Industry

One interesting and unexpected consequence of today’s situation is how commercial insurance providers are using their considerable assets.

Because it’s in their best interest to minimize the effect of these climate events, some business insurers are making financial decisions aimed at reducing climate change. They’re phasing out coal investments, including stock holdings, and some are even declining to provide insurance protection to entities that rely on fossil fuels.

Lean on Commercial Insurance Consultants to Find the Best Solutions

Getting your commercial insurance coverage wrong can have devastating financial consequences. Given the current commercial insurance landscape and the massive implications of diminished capacity among commercial insurance providers, you need an expert to navigate you through.

To help ensure adequate coverage and the most favorable terms possible, rely on experienced, trusted, knowledgeable commercial insurance consultants.

We’re MB Davis Group, a business insurance consulting firm offering more than one hundred years of combined experience in the field. Our job is to secure the best coverage for you and your business. Our management group doesn’t sell you insurance; we help you decide what coverage is most beneficial.

Have any questions?

Start the conversation today. We’re always happy to answer your questions!